Car Insurance KSA-How to Find the Cheapest Vehicle Insurance

Car insurance KSA is essential for all drivers. It protects individuals from financial loss due to accidents, theft, and other damages. Finding affordable vehicle insurance is always a challenge in Saudi Arabia, but knowing the requirements and types of coverage available can help drivers make informed choices. The growing number of insurance providers has made it difficult for drivers to select the cheapest car insurance in KSA.

Car insurance in KSA is mandatory for all citizens and expats. Drivers must have at least third-party liability insurance. This basic coverage helps protect against claims from other parties in case of an accident.

Choosing the right insurance policy can seem challenging. Drivers must compare different plans and understand the benefits and costs to ensure they select the best option for their needs and budget.

Insurance Regulatory Framework in KSA

Car insurance KSA is essential for anyone who owns and operates a vehicle. It offers protection against financial losses from accidents, theft, and damages. Understanding the regulatory framework and available policy types is crucial for drivers.

The Saudi Central Bank (SAMA) regulates vehicle insurance in the Kingdom. This authority oversees the insurance sector, ensuring companies comply with laws and provide fair coverage options.

Every vehicle owner must have a minimum of third-party insurance. This policy covers damages caused to other vehicles and injuries to others in the event of an accident. Insurers in KSA are required to provide consumers with clear information about their policies, including terms and conditions.

Types of Car Insurance KSA Policies

In Saudi Arabia, there are two main types of vehicle insurance policies: the third-party insurance and the comprehensive insurance.

Third-Party Vehicle Insurance

Third-party car insurance in Saudi Arabia is the basic level of coverage. It covers damages to other parties involved in an accident but does not cover damages to the insured’s vehicle.

Comprehensive Car Insurance

This policy offers a higher level of protection. It covers damages to the insured’s vehicle and provides additional benefits like theft protection, fire damage, and natural disasters.

Both policy types have their benefits and limitations. Choosing the right policy depends on individual needs and driving habits.

Mandatory Insurance Coverage

In Saudi Arabia, vehicle insurance is essential for all drivers. The two main types of mandatory coverage are Third-Party Liability Insurance and Comprehensive Vehicle Insurance. Understanding these options helps drivers meet legal requirements and protect their interests.

The two main types of mandatory insurance coverage are:

1-Third-Party Liability Insurance Coverage

Third-Party Liability Insurance is required by law in Saudi Arabia. It covers damages caused to other people and their property in the event of an accident. It ensures that if the driver is at fault, the insurance company will pay for the damages up to a certain limit.

Key points of Third-Party Liability Insurance include:

2-Comprehensive Car Insurance

Comprehensive Vehicle Insurance is not mandatory but is often recommended. It covers damages to the insured vehicle and provides broader protection than third-party insurance.

This type of policy compensates for theft, fire, or accidents involving other vehicles.

Key features of Comprehensive Vehicle Insurance are:

How to Select Car Insurance Providers in KSA

Buying vehicle insurance in Saudi Arabia involves careful consideration of various factors. This process includes selecting the right insurance provider, understanding premiums, and reviewing what is included or excluded in policies.

Selecting the Right Insurance Provider

Choosing an insurance provider is crucial for getting the right coverage. Start by researching companies that offer vehicle insurance in Saudi Arabia. Look for companies with a strong reputation for customer service and financial stability.

Consider reading online reviews and checking ratings from reliable sources. It’s also helpful to ask friends and family for recommendations. Once a list of potential providers is made, contact them for quotes. Compare the rates and services they offer.

Make sure to verify if the provider is licensed to operate in the region. It is essential to understand the claim process and how quickly they respond to claims. A good policy is not just about the price but also about reliable service during difficult times.

Understanding Car Insurance Premiums

Insurance premiums are the amounts paid for coverage, typically charged monthly or annually. Multiple factors affect the premium amount. These can include the driver’s age, driving history, and the type of vehicle insured.

For instance, younger drivers or those with past accidents may face higher premiums. Comparing quotes from different insurers can help find the best price.

Some companies offer discounts for safe driving, bundling policies, or completing defensive driving courses. Understanding these factors can help manage costs. It’s important to check if the premiums change if a driver switches to a different vehicle or experiences a life change.

Policy Inclusions and Exclusions

Not all vehicle insurance policies are the same. Each policy has specific inclusions and exclusions that detail what is covered. It is important to read through these carefully.

Common inclusions are coverage for damage from accidents, theft, and natural disasters. Some policies also cover medical expenses related to car accidents. On the other hand, exclusions may include damage from racing, driving under the influence, or using the vehicle for business purposes.

Policyholders should also inquire about coverage limits. Knowing the details helps prevent surprises when filing a claim. Reading the fine print ensures that the right coverage is in place for personal needs.

Top Vehicle Insurance Providers in KSA

In Saudi Arabia, several car insurance companies are well-regarded for their services, customer support, and comprehensive coverage options. Some of the best car insurance providers in Saudi Arabia include:

- Tawuniya Car Insurance KSA

- Medgulf Vehicle Insurance

- Malath Insurance

- Allianz Saudi Fransi

- Walaa Insurance

- Saudi Arabian Cooperative Insurance

- Bupa Arabia Vehicle Insurance

How to Find the Cheapest Car Insurance KSA?

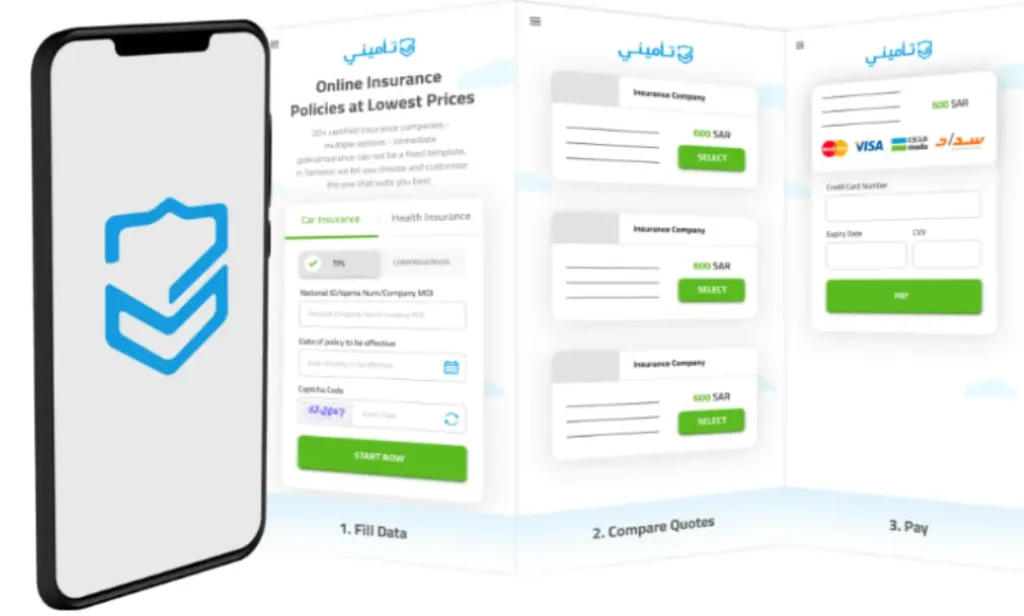

Still worried about buying the cheapest car insurance in KSA, here is the solution in the form of Tameeni. It is a perfect solution for all your vehicle insurance requirements. Tameeni car insurance simplifies the process of finding the cheapest car insurance in KSA. It enables you to compare the rates of various insurance providers and select the best plan that suits your needs. Tameeni Car Insurance is an authorized company that provides both third-party and comprehensive insurance.

Therefore, if you are looking for an online solution for your vehicle insurance problem, look no further than Tameeni because it allows you to compare rates and benefits offered by various car insurance service providers. You need not to visit insurance providers’ offices. The detailed process is as follows:

If you are an Android or iPhone user, you can download and install the Tameeni App from the Google Play Store or Apple App Store and use it after registering your account.

Claims and Dispute Resolution

When a vehicle accident occurs, understanding how to file a claim and resolve disputes is important. Insurance companies in the Kingdom of Saudi Arabia have specific processes for these situations.

Filing An Insurance Claim

To file an insurance claim, the policyholder must take several steps:

- Report the Incident: The first action is to notify the insurance company about the accident as soon as possible. It usually requires providing basic details like the date, time, and location of the incident.

- Gather Documentation: The claimant should collect the necessary documents. These may include the police report, photographs of the accident, and contact information for witnesses.

- Complete the Claim Form: The next step involves filling out the claim form provided by the insurance company. It is essential to complete this accurately to avoid delays.

- Follow-up: After submission, keeping in touch with the insurer is important. It ensures that any additional information required is provided promptly.

Each option offers a pathway to address concerns and seek fair outcomes in disputes related to vehicle insurance.

Consumer Rights and Responsibilities

In Saudi Arabia, consumers have specific rights and responsibilities when it comes to vehicle insurance. Knowing these can help policyholders make informed choices and understand their obligations.

Understanding Policyholder Rights

Policyholders in Saudi Arabia have clear rights regarding their vehicle insurance. These include the right to receive accurate information about their policy. They must understand the terms and conditions.

They also have the right to ask questions and get clear answers. If a claim is made, policyholders have the right to a timely response from their insurance company. They should be informed about the claim process and any decisions made.

Another key right is the right to fair treatment. Insurance companies cannot discriminate against any policyholder based on irrelevant factors. Policyholders should also receive compensation that fairly reflects their losses.

Responsibilities of Insured Drivers

Insured drivers have specific responsibilities they must follow. First, they must provide accurate information when applying for insurance. Failing to do so can lead to denied claims or canceled policies.

Drivers are also responsible for making timely payments. Keeping up with premium payments ensures that coverage remains active. If payments are late, coverage may lapse, leaving them unprotected.

Additionally, drivers must report any accidents or incidents to their insurer as soon as possible. This quick action is crucial for processing claims efficiently. Lastly, policyholders should follow all laws and regulations related to vehicle insurance to remain compliant and avoid penalties.

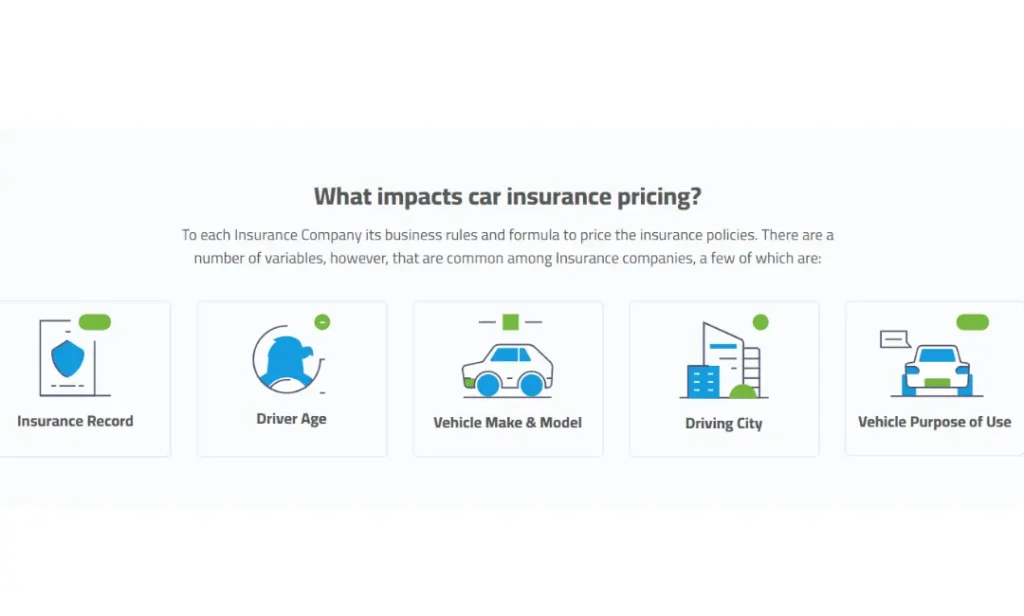

Factors Impacting Car Insurance Pricing

Each insurance company has its unique formula to calculate car insurance pricing. However, certain factors impact the insurance pricing of all the companies. These factors are:

- The previous insurance record of the policyholders is vital for determining the insurance pricing.

- Car insurance KSA pricing may vary with the driver’s age.

- Your vehicle make and model are also important factors in determining insurance pricing.

- Insurance pricing may also vary from city to city. It may be greater for big and busy cities.

- Car insurance costs may also change with the purpose of use of the vehicle. Usually, insurance costs for commercial vehicles are greater than for domestic usage vehicles.

Conclusions

To sum up, we can say that Tameer Online has revolutionized the way people select insurance providers for their vehicles. It helps to compare policies offered by all major car insurance KSA providers. The citizens and expats need not visit the insurance provider offices and wait in lines. Instead, they can compare the features and plans of all insurance providers and go with the best plan that suits their needs and requirements.