Health Insurance in Kuwait- A Comprehensive Guide for Citizens and Expats

Kuwait is a small country located in the Middle East, known for its vast oil reserves and rich culture. In recent years, the country has seen significant economic growth, leading to an increase in the standard of living and demand for better healthcare services. As a result, the government has made efforts to improve the healthcare system, including the implementation of mandatory health insurance for all residents.

Medical insurance in Kuwait is mandatory for all residents, including expatriates. The government has made it a requirement to ensure that everyone has access to quality healthcare services. Kuwait has several health insurance companies that offer a range of plans to suit different needs and budgets. These plans cover a variety of medical services, including hospitalization, surgery, and outpatient care.

Overview of Health Insurance in Kuwait

The Public Health System in Kuwait is managed by the Ministry of Health MoH. Here is a general overview of the Medical Health Insurance in Kuwait that would help you understand how it works in Kuwait:

HealthCare System Structure

The healthcare system in Kuwait is divided into two sectors: public and private. The Ministry of Health manages the public sector and provides free or low-cost healthcare services to Kuwaiti citizens and expatriates who hold valid residency permits. The private sector, on the other hand, is managed by private companies and individuals who provide healthcare services for a fee.

The public sector is the main provider of healthcare services in Kuwait, with more than 80% of the population relying on it for their healthcare needs. The public healthcare system is divided into primary, secondary, and tertiary levels. Primary healthcare centres provide basic healthcare services, such as check-ups, vaccinations, and treatment for minor illnesses. Secondary healthcare centres provide more specialized services, such as surgery and emergency care. Tertiary healthcare centres provide highly specialized services, such as organ transplants and cancer treatment.

Insurance Coverage Mandates

In Kuwait, medical insurance is mandatory for all expatriates working in the private sector. The government provides health insurance coverage for Kuwaiti citizens and expatriates working in the public sector. Private health insurance is also available for those who wish to have additional coverage.

The insurance coverage provided by the government is comprehensive and covers a wide range of healthcare services, including hospitalization, surgery, and medication. Private health insurance plans vary in coverage and cost, depending on the provider and the level of coverage required.

Overall, the healthcare system in Kuwait provides adequate healthcare services to its citizens and residents. Mandatory health insurance coverage ensures that everyone has access to basic healthcare services, while private health insurance provides additional coverage for those who require it.

Types of Health Insurance Plans

There are three kinds of medical insurance plans available for locals and expatriates. Everyone can buy any of the plans that suit their need. These insurance plans are:

Private Health Insurance

Several insurance companies offer private insurance plans in Kuwait. These plans typically provide coverage for medical services such as hospitalization, surgeries, diagnostic tests, and prescription drugs. Private health insurance plans may also offer additional benefits such as dental and vision coverage.

Public Health Insurance

The Ministry of Health provides public medical insurance in Kuwait. This insurance plan is available to all Kuwaiti citizens and provides coverage for a range of medical services, including hospitalization, surgeries, and prescription drugs. The Ministry of Health also provides free healthcare services to citizens at public hospitals and clinics.

Expatriate Health Insurance

Expatriate medical insurance plans in Kuwait are designed specifically for non-Kuwaiti residents living and working in the country. These plans typically offer coverage for medical services such as hospitalization, surgeries, and prescription drugs. Expatriate health insurance plans may also provide coverage for emergency medical evacuation and repatriation services.

Overall, individuals in Kuwait have access to a variety of health insurance plans, both public and private, that offer coverage for a range of medical services.

Major Health Insurance Companies in Kuwait

There are many insurance provider companies in Kuwait, each with its benefits and insurance plans. The prominent medical insurance operators in Kuwait are:

Kuwait Insurance Company

Kuwait Insurance Company is the largest insurance company in Kuwait and offers a range of insurance products to individuals and businesses. It is one of those insurance companies that offer insurance for everything you have. KIC won the “Most Innovative Marketing Campaign” award in 2022 and has been offering insurance services to Kuwaiti citizens and expatriates for the last 60 years. It covers all kinds of accidents and deaths, along with 38 critical illnesses and diseases.

Gulf Insurance Group

Gulf Insurance Group is another major player in the Kuwaiti insurance market, offering a range of insurance products to individuals and businesses. It has been offering insurance services since 1962 and has 3500K+ consumers. You can find more details about it on the Kuwait Stock Exchange (Boursa).

Warba Insurance Company

Warba Insurance Company is a relatively new player in the Kuwaiti insurance market compared to other insurance service providers. Still, it has quickly gained a reputation for offering high-quality products and services. Nowadays, it offers a comprehensive range of products to both citizens and expatriates. Warba Insurance offers life insurance, medical insurance, marine insurance, motor insurance, and FGA insurance for individuals.

Takaful International Company

Takaful International Company is another major player in the Kuwaiti insurance market, offering a range of insurance products to individuals and businesses.

Kuwait Insurance Company is the largest health insurance company in Kuwait, with a market share of over 30%. Gulf Insurance Group is the second largest health insurance company in Kuwait, with a market share of around 20%. Warba Insurance Company and Takaful International Company have smaller market shares but are still considered major players in the Kuwaiti health insurance market.

All of these companies have a good reputation for offering high-quality products and services and are known for their efficient claims processing and customer service. They also offer a range of insurance products to suit different needs and budgets, including individual and group health insurance plans.

Overall, the Kuwaiti health insurance market is highly competitive, with several major players vying for market share. However, these companies are all well-established and have a good reputation for offering high-quality products and services to their customers.

Policy Coverage and Benefits

Policy coverages and benefits of various health insurance providers in Kuwait are as follows:

Inclusions and Exclusions

Kuwait health insurance policies typically cover a range of medical services, including hospitalization, outpatient care, prescription drugs, and diagnostic tests. However, it is important to note that policies may vary in terms of the specific services covered, as well as any limits or exclusions that may apply.

Some common exclusions in Kuwait’s health insurance policies include pre-existing conditions, cosmetic treatments, and experimental therapies. Additionally, policies may have limits on the amount of coverage provided for certain services, such as mental health care or physical therapy.

It is important for individuals to carefully review the details of their policy to understand what services are covered and any limitations or exclusions that may apply.

Additional Benefits

In addition to basic medical coverage, some Kuwait health insurance policies may offer additional benefits, such as dental and vision care, maternity care, and wellness programs.

Dental and vision care may include routine check-ups, cleanings, and treatments for common dental and vision problems. Maternity care may cover prenatal visits, labour and delivery, and postpartum care.

Wellness programs may include access to fitness classes, nutrition counselling, and other resources to help individuals maintain good health and prevent illness.

Again, it is important to carefully review the details of a policy to understand what additional benefits, if any, are included and any limits or exclusions that may apply.

Eligibility and Enrollment

After learning about the health insurance system in Kuwait, it is imperative to provide you with the eligibility criteria and policy enrollment process.

Eligibility Criteria

To be eligible for health insurance in Kuwait, individuals must be citizens or residents of Kuwait. Expatriates must have a valid residency and work permit. In addition, individuals must not have any pre-existing medical conditions that are deemed uninsurable by the insurance companies.

Enrollment Process

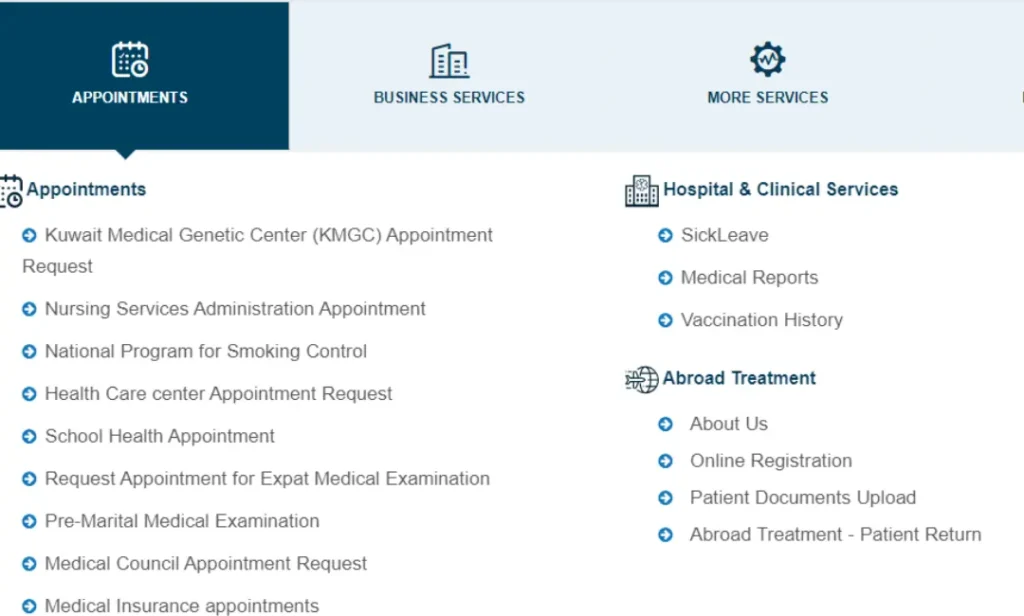

Enrollment in Kuwaiti health insurance plans is typically done through an employer. Employers are required to provide health insurance to their employees and their dependents. Individuals who are not employed or self-employed can purchase health insurance directly from insurance companies.

During the enrollment process, individuals will need to provide personal information, civil ID status, and medical history. Insurance companies will use this information to determine eligibility and coverage options. Once enrolled, individuals will typically receive an insurance card that they can use to access medical services.

It is important to note that there may be waiting periods for certain types of coverage, such as maternity care or pre-existing conditions. Additionally, individuals may need to pay deductibles or co-payments for some medical services.

Cost and Affordability

Health insurance costs in Kuwait are minimal and everyone can easily afford to buy a plan. Moreover, the Kuwaiti government also provides subsidies on several grounds.

Premiums and Deductibles

Kuwait’s health insurance premiums and deductibles vary depending on the type of plan and the insurance company. Generally, premiums are paid on a monthly or yearly basis, and deductibles are the amount of money that policyholders must pay out of pocket before their insurance coverage begins.

Policyholders who opt for higher premiums can often enjoy lower deductibles and more comprehensive coverage. However, those who choose lower premiums may have higher deductibles and limited coverage.

Government Subsidies

The Kuwaiti government provides subsidies to help citizens and residents afford health insurance. These subsidies are based on income level and family size, and they can cover up to 75% of the cost of premiums.

In addition, the government offers free health care services to Kuwaiti citizens and residents at public hospitals and clinics. However, these services may have long wait times and limited availability of specialized treatments.

Overall, while health insurance in Kuwait can be expensive, government subsidies and free health care services can help make it more affordable for those who need it.

Legal and Regulatory Framework

Knowing Kuwait’s legal and regulatory framework is also necessary for citizens and expatriates to buy a plan and enjoy its full advantages.

Kuwait Insurance Laws and Regulations

Kuwait has a well-established legal and regulatory framework for health insurance. The Ministry of Health is responsible for regulating and supervising the health insurance industry in Kuwait. The ministry works closely with the Kuwait Insurance Federation to ensure that all health insurance companies operating in the country are compliant with the regulations.

The primary law governing the health insurance industry in Kuwait is Law No. 24 of 1961. This law regulates the establishment and operation of insurance companies in the country. The law also outlines the requirements for obtaining a license to operate as an insurance company in Kuwait.

In addition to the primary law, several regulations govern the health insurance industry in Kuwait. These regulations cover various aspects of the industry, including licensing, solvency, and consumer protection.

Consumer Rights and Protections

Kuwait has robust consumer protection laws that apply to the health insurance industry. The Ministry of Health is responsible for ensuring that health insurance companies comply with these laws. The ministry has established a Consumer Protection Unit to handle complaints and disputes related to health insurance.

Under Kuwaiti law, health insurance companies are required to provide their customers with clear and accurate information about their policies, including the terms and conditions, coverage, and premiums. They are also required to provide a detailed explanation of any exclusions or limitations in the policy.

If a customer has a complaint or dispute with a health insurance company, they can file a complaint with the Consumer Protection Unit. The unit will investigate the complaint and work with the insurance company to resolve the issue. If the issue cannot be resolved, the customer can file a lawsuit in court.

Overall, the legal and regulatory framework for health insurance in Kuwait is well-established and provides strong protections for consumers.

Challenges and Considerations

In spite of the well-established health sector, medical insurance companies face a lot of challenges. Some of the challenges are:

Accessibility Issues

One of the biggest challenges facing the health insurance industry in Kuwait is accessibility. While there are several health insurance companies operating in the country, not all Kuwaitis have access to health insurance. This is especially true for low-income individuals and families who cannot afford health insurance premiums. Additionally, some areas of the country have limited access to healthcare facilities, making it difficult for individuals to receive the care they need.

Future Trends in Health Insurance

As healthcare costs continue to rise, health insurance companies in Kuwait will need to find ways to keep premiums affordable while still providing comprehensive coverage. One potential trend is the use of technology to improve healthcare delivery and reduce costs. For example, telemedicine services could allow patients to receive medical care remotely, reducing the need for expensive hospital visits.

Another trend is the use of data analytics to improve health outcomes and reduce costs. By analyzing patient data, health insurance companies can identify high-risk individuals and provide them with targeted interventions to prevent more serious health problems down the line.

Overall, the health insurance industry in Kuwait faces several challenges, but there are also opportunities for innovation and growth. By addressing accessibility issues and embracing new technologies, health insurance companies can provide better care to their customers while remaining competitive in the market.

Frequently Asked Questions (FAQs)

What are the most affordable health insurance options in Kuwait?

There are several health insurance options available in Kuwait that are affordable for individuals and families. It is recommended to compare insurance policies and premiums from different insurance providers to find the most suitable one.

Which are the top-rated health insurance providers for expatriates in Kuwait?

Some of the top-rated health insurance providers for expatriates in Kuwait include Daman, Aetna International, and Cigna Global. It is important to research and compare policies and premiums from different providers before making a decision.

How can I renew my health insurance policy online in Kuwait?

Most insurance providers in Kuwait offer online renewal options for health insurance policies. Customers can log in to their account on the provider’s website and renew their policy online.

What are the key benefits of private medical insurance in Kuwait?

Private medical insurance in Kuwait offers several benefits such as access to private hospitals and clinics, shorter waiting times, and personalized care. It also provides coverage for medical expenses such as hospitalization, surgeries, and consultations.

Which company offers the best coverage for health policies in Kuwait?

Several insurance providers in Kuwait offer comprehensive coverage for health policies. It is recommended to compare policies and premiums from different providers to find the best coverage for individual needs.

How does the cost of health insurance in Kuwait compare for locals versus expatriates?

The cost of health insurance in Kuwait varies for locals and expatriates. Expatriates generally pay higher premiums due to their higher risk profile. However, it is recommended to compare policies and premiums from different providers to find the most suitable one.